OpenBet is back in the media spotlight so iGaming Business met up with chief executive Jeremy Thompson-Hill to talk about the group’s client list, Playtech, the evolution of the sector and if we can expect an exit from private equity owners Vitruvian in 2015.

By Jake Pollard

Interviewing OpenBet chief executive Jeremy Thompson-Hill is noteworthy for a number of reasons. Among them is the fact the west London-based company provides and manages the betting and gaming platforms of the leading online bookmakers in the UK and other countries such as Canada or Denmark.

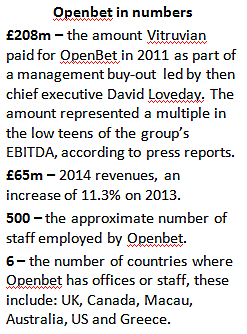

Of more relevance though is the fact that the group has been conspicuous for its lack of media presence in the past few years. We have heard little from OpenBet since it was acquired by private equity group Vitruvian Partners for £208m in 2011 as part of a management buy-out led by then chief executive David Loveday.

The online betting sector has changed considerably in the three years since: the dot com model is not applicable to most of OpenBet’s clients, who on the whole operate in regulated environments as individual markets implement their dot country regulations; mobile betting has taken the industry by storm and new competitors have entered the fray.

As far as OpenBet is concerned, the new(ish) suppliers vary in size and scope but the one that will have made it sit up and take notice is, of course, Playtech. The Israeli igaming powerhouse has been vocal in stating that it plans to become the leading supplier to online betting operators as it wants them to move away from their “legacy systems”.

In other words, Playtech wants the likes of William Hill or Paddy Power to leave OpenBet and move to its Geneity betting platform. But more on Playtech and Jeremy Thompson-Hill’s take on the group later.

The OpenBet boss has been with the company since 1999 and has seen it evolve dramatically during that time, from data and feeds provider as part of the NDS/News Corp conglomerate to leading online betting platform provider.

OpenBet post-Vitruvian acquisition

Starting with the obvious, why the renewed media approach after three years of press blackout?

Thompson-Hill says simply that “there is more substance to it (OpenBet). From 1999 to 2012 we had had near constant double-digit growth. We then went through a period of change and we could have made more noise but I wanted to make sure we had the right message for the market. We needed to reinvest and restructure the company and this is what we have been doing in the past two years”.

The 2011-2012 period follows the Vitruvian acquisition, how much of the restructure, which, if one is honest, many people equate with PE-led cost cutting – was driven by the new owners wanting to ‘hit the numbers’ no matter what?

“There are pressures when PE and venture capital firms enter the fray but it would be wrong to think that they just want to cut costs. It is in their interest to build a strong business with a vision that is constructive and engaged. We wouldn’t have chosen Vitruvian if we thought they didn’t share our vision,” says Thompson-Hill.

Speaking of private equite visions, the standard timeframe for PE exits is between three and five years and 2015 marks the start of the fifth year of the acquisition by Vitruvian. How much of the increased media activity is part of raising OpenBet’s profile to prepare it for a sale?

“Of course Vitruvian will look to exit at some point, but an exit shouldn’t be viewed in a negative light, it also means success,” says Thompson-Hill. That last point is undeniably true, if Vitruvian exits in a satisfactory way, it will mean the PE group and OpenBet will have fulfilled their respective parts of the deal.

But for OpenBet, its relationship with Vitruvian begs the question of where do the increased margins come from for the betting specialist? After all, private equity outfits first and foremost want their investments to ‘hit the numbers’, either through new business or profits. The question for OpenBet then is where do the new (and big enough) clients or increased profits come from?

It already supplies the biggest online sportsbooks in the UK and while the client list from Canada (British Columbia, Atlantic Provinces, Loto-Québec), Denmark (Danske Spil) or France (PMU by way of Paddy Power management) is impressive, the British Isles still represent the core of its revenues and profits.

In addition, one wonders who would buy OpenBet. The only player in town from a supplier point of view is Playtech and it has its own plans for its Geneity platform, although it doesn’t have a comparable client base. One can speculate that a lack of major sign ups might prompt a renewed focus on OpenBet by the Israeli group, but that is exactly what it is, speculation.

Hills renewal and evolving roles

Staying on the Playtech theme, was Jeremy Thompson-Hill ever worried about the threat it presented as OpenBet was negotiating the renewal of the William Hill contract? Did Hills ever pressure him with veiled threats to decamp in favour of Playtech, bearing in mind the very close relationship the UK bookie has with Teddy Sagi’s company?

“No that never happened,” he responds categorically. “The offer had to be right and they had to feel that it was right. The depth and strength of our relationship is such that they didn’t need to play that game. What they asked us for was a partnership and great flexibility.”

Thompson-Hill admits that retaining a client like William Hill was a huge boost for OpenBet. “Absolutely, from a personal and an OpenBet point of view. You need to be backed by your biggest clients. It sends a strong message internally and to the market. What underpinned the deal is that they believed in our strategic vision and felt that it was aligned to the William Hill vision and strategy. If this hadn’t been the case we wouldn’t have got the signature.”

Returning to product, he adds: “Flexibility is the keyword and is at the heart of our strategy. It is what sets us apart from our competitors. It is hard to provide but that is what we are focused on. People will always come to you and ask you to deploy a sportsbook in two weeks, but what they also ask for is a unique offering and flexibility, which is what we are focused on. You also have to remember that some of our competitor’s platforms are walled gardens.”

But with flexibility as the watchword, how worried is Thompson-Hill about operators carrying out growing numbers of functions that were once done by the likes of OpenBet? If the logic is pushed to its conclusion, it means that suppliers such as OpenBet increasingly will be required to do an important but ever smaller number of tasks.

The OpenBet boss doesn’t see it that way. The increasing fragmentation of the roles and functions in the online betting sector in fact means more opportunities, while dot country regulation means working in markets where the group wasn’t active previously, as shown by markets such as France and Denmark.

As an example, he cites Paddy Power’s management of PMU’s fixed-odds offer in France off the back of the OpenBet infrastructure. Thompson-Hill says such a set up “is part of a part-managed solution we offer where operators can have access to our back-end and price up markets It is about honing in on our core skills and leveraging those of our partners to create a true best in class offering. “

But doesn’t that mean some of OpenBet’s existing clients recruiting their own clients using its technology and systems? “No, Paddy Power or Betgenius do that for their clients because they’re very good at it. We believe it’s beneficial for us as the sector in general expands.

“Also, we don’t claim to be able to do everything. That’s not detrimental to us or our clients. For both them and us it’s part of the evolution of the sector and taking a long-term perspective so that we’re all operating from a stronger position.”

POC, Canada and planned exits

Mention of evolution brings us to Point of Consumption in the UK and its effects on OpenBet and its clients. What has the firm been doing to mitigate the impact of the change in its core UK market?

For Thompson-Hill, POC, once again, is part of the evolution of the sector. He says: “We only work in regulated markets and POCT is part of markets regulating and evolving. There will be some consolidation but we just have to look at it as a new playing field that we will embrace. We have to make the most of it by increasing the lifetime values of players and, if anything, work even harder that we have been doing towards having a stronger and more productive player base.”

OpenBet has made substantial headway into Canada in the past few years as it has signed up British Columbia Lottery Corporation, Loto-Québec and the Atlantic Provinces. What are the plans for that market?

“We’re very happy with it, even if at the time we didn’t realise the BCLC deal would lead to (the) Loto-Québec (deal). It is a great opportunity for us to showcase how the OpenBet system can work in the WLA (World Lottery Association) market, providing a solution that allows state monopoly operators to compete against the grey market.” says Thompson-Hill.

“The next stage for us in Canada is to bring our omni-channel offering to life, the convergence opportunities are great. That’s what it’s about: offering players the tools they need, so they are able to play via any channel and to drive the convergence and analyse the activity.”

Which brings us on to big data, everyone is talking about it, but how will OpenBet use all the information at its disposal? “The player is the ultimate boss. We need to understand them more so we can use this knowledge, to develop technology that enables our customers to drive up lifetime player values.

“For example we will be able to anticipate what punters want to bet on based on previous activity to make it predictive and really deliver a personalised experience. It’s used in many other sectors and can also be used to address problem gambling issues. If you know a punter bets out of control at 11pm on a Friday night you can address that by taking steps to change the pattern. There is so much more that we can do with it.”

Many concur that the igaming industry hasn’t made productive of all the player data it has at its disposal but hopefully that will change as minds focus on the topic.

OpenBet has retained its majors clients, which does represent a very important and symbolic message as Playtech circles, and seems to have a stable and well-oiled modus operandi. But there is also little doubt that the five-year plan is approaching fruition for Vitruvian and that an exit will be on the cards in the near future.

By any standard the company’s client list couldn’t be any stronger, the question for OpenBet’s owners will be whether they are able to find a buyer who values it as much and is willing to pay the corresponding price.

source : www.igamingbusiness.com