Deposit amounts and conversion rates were up in the casino vertical as sports bettors starved of fixtures turned their attention to casino games instead.

Deposit amounts and conversion rates were up in the casino vertical as sports bettors starved of fixtures turned their attention to casino games instead.

With so many people currently self-isolating or quarantined as countries around the world attempt to combat the spread of coronavirus, the online gaming industry is booming.

Although most sporting events have been cancelled or postponed, the decline in numbers last month wasn’t as extreme as one might have expected. It’s important to note that until mid-March, many sporting events were still taking place and this is evident in this report.

The players who continue to play online right now (both casino and sports) are probably the stronger, more experienced players. Here we analyse online playing activity in different European countries in March.

Sporting standstill

Although most of the big sporting leagues have shut down, betting on leagues that are more niche is still possible. For example, still playing are the Belarusian Premier League, Tajikistan football, Nicaraguan baseball and a few horse racing events that are taking place without any crowds.

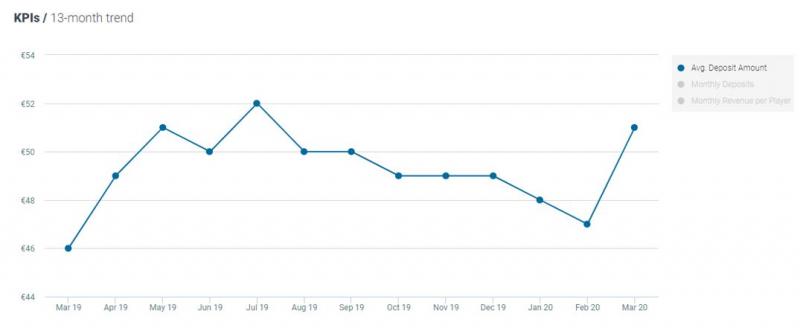

However, overall the average number of deposits per player decreased by 6% month-on-month (MoM). Perhaps surprisingly, on a year-on-year (YoY) basis these were up 4%.

In Italy, however, we saw a decrease both MoM (by 5%) and YoY (by 4%).

The same trend appeared in monthly revenue per player, where there was a decrease of 11% MoM but an increase of 9% YoY.

In the UK, the trend was negative across the board, with a decrease of 22% MoM and a decrease of 15% YoY.

In Spain, on the other hand, there was a decrease of 18% MoM but a slight increase of 3% YoY.

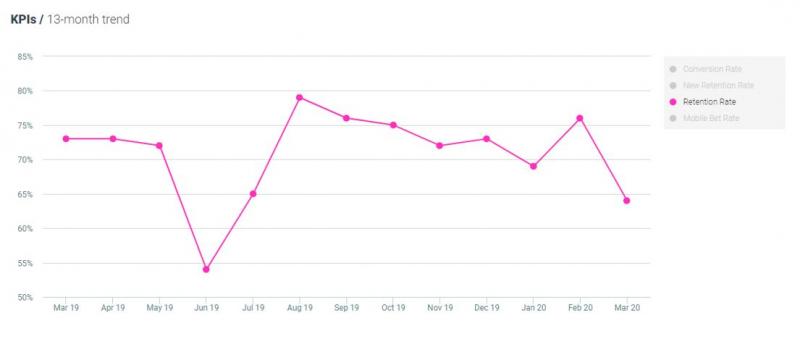

The overall retention rate among sports betting players decreased by 7% MoM and 5% YoY.

In Germany, the falls were more significant, with a 16% decrease MoM and a 12% decrease YoY.

Perhaps unsurprisingly given the lack of sporting events, new retention rates – players who made their first deposit in February and remained active in March – suffered even larger falls.

In Italy, for example, there was a 15% MoM decrease and an 18% YoY decrease in the new retention rate.

Bettors turn to casino

Since the beginning of March, the number of casino players has been increasing every week. In part this is due to an increase in sports bettors turning to casino games.

As of March, the average single deposit amount was €34. That represented a 3% MoM increase but a 6% YoY decrease.

In the Netherlands, the increase was particularly strong – we saw an increase of 9% MoM and 11% YoY, taking the average single deposit amount to €51.

Strong conversion

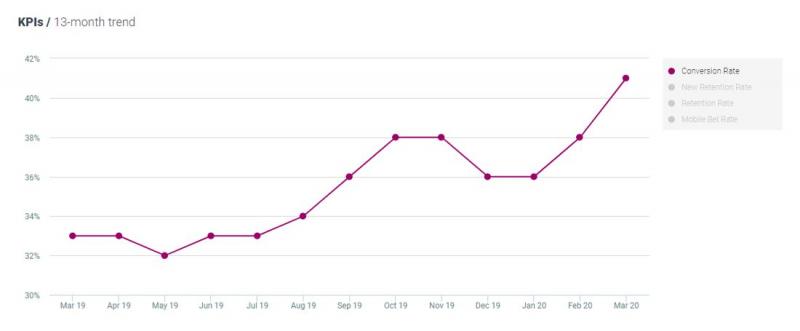

The conversion rate – the number of first-time depositors divided by the number of registered players – also improved last month.

The overall conversion rate increased by 8% MoM, with an even greater increase of 24% YoY. This means the conversion rate now stands at 44%, compared with 33% in the same month last year.

We saw an even more pronounced upward trend in Italy, with conversion rates last month standing at 58%, an increase of 18% both Mom and YoY. With minimal sports to bet on, it’s obvious that players are turning to casino games in Italy.

Mobile bet rate rises further

There’s been a generally rising trend in the mobile bet rate in recent times, and last month this was up 40% YoY and 8% MoM, with the figure now standing at 67%.

The key takeaway from last month is that with most sport betting events cancelled or postponed and physical casinos closed, more people are turning to online casino games for entertainment. It will be interesting to see if this trend persists in the coming months.

About iGaming Pulse:

iGaming Pulse is an industry benchmark tool for the gaming sector. iGaming Pulse enables gaming operators to accurately assess their overall performance against industry-wide key performance indicators.

Its figures are updated on a monthly basis. It enables gaming operators to gain a clearer understanding of how their KPIs compare against the rest of the industry, broken down by geography and game type. This type of data, which is made publicly available for the first time, provides operators with the ability to conduct comparative analysis and derive insight into how their performance compares with industry averages.

iGaming Pulse comprises of data collected from over 200 online casinos and sports betting companies, including industry giants and boutique operators, providing an accurate, statistically significant sample of the industry. Access to this information is vital for operators that are limited to only their own data. Optimove’s iGaming Pulse is now fully accessible, ensuring operators will have a clearer overview of how they compare to the industry.