With Germany having announced plans to nationally regulate online casino for the first time in 2021, Ken Muir looks at how the current online slots market breaks down in terms of supplier share, top games and the changing content mix across leading operators. He also provides a snapshot of the live casino space ahead of German state lotteries being given the option to extend their monopoly into table games

With Germany having announced plans to nationally regulate online casino for the first time in 2021, Ken Muir looks at how the current online slots market breaks down in terms of supplier share, top games and the changing content mix across leading operators. He also provides a snapshot of the live casino space ahead of German state lotteries being given the option to extend their monopoly into table games

In March, the German prime ministers approved regulations to legalise and regulate online casinos on the national level for the first time.

The offer of online casino and slots from 1 July 2021, subject to ratification by each state parliament and EU approval, will however come with significant restrictiions.

For slots, these include a stake cap per spin of €1, with each spin to last at least five seconds, with no autoplay or jackpots. The mandatory deposit limit of €1,000 across all providers first included in the third State Treaty will also remain, with advertising prohibited between 6am and 9pm.

Stakeholders including operator trade body the DSWV have argued such restrictions will undermine German authorities’ player protection and channelisation aims by increasing the attractiveness of offshore-regulated casinos to German players.

The licensing authority for sports betting in Germany claimed in February that the approval of 50 operators from the 30 applications and 20 expressions of interest received would channel up to 99% of activity into the legal realm.

In combination with the more fragmented nature of operator shares in online casino compared to betting (see our Italy Dashboard for an example) these restrictions appear likely to result in a lower channelisation rate for casino than for sports betting.

That said, most of the operators and SPs currently accounting for the lion’s share of the market, many of which already operate online casino under Schleswig-Holstein licences, will likely seek approval to enter the nationally regulated space in 2021.

The snapshot that follows will therefore give a strong flavour of how the market is likely to break down post-regulation, notwithstanding the re-entry of high-profile current absentees, such as Novomatic/Greentube.

The viability of Germany’s new regulation will be the subject of an iGB webinar on 6 May featuring leading gaming law experts Wulf Hambach and Rolf Karpenstein as well as Greentube COO Georg Gubo. You can find out more and register here.

Important note: for enhanced readability please click on each of the graphics to open and view in a new tab

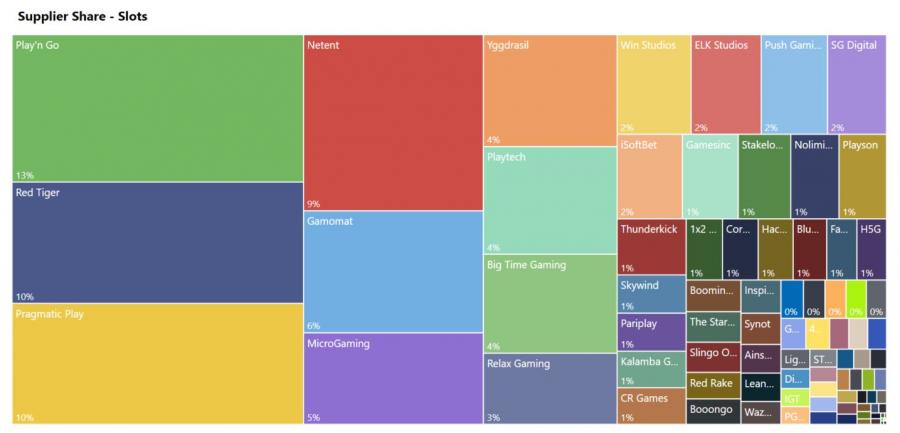

Slots composition Q1 2020

We looked at the top 50 games based on their position In the main lobbies of the 10 operator sites we analysed each day during Q1 2020, which we have listed at the end of this article. The visual below aggregates the findings by game supplier.

Typical for many European online slots markets NetEnt/Red Tiger has the largest market share with Play’n Go close behind.

Interestingly, Pragmatic Play also commands a significant share there following substantial growth in the period since Q1 2019. German games studio Gamomat also has a considerable and growing share of the German online slots market.

Top slot games Q1 2020

The chart below shows the top 20 slot games by content share in Q1 2020 in Germany. There are some progressive jackpot games present, such as Mega Moolah (Microgaming) and Midas Gold (Red Tiger).

As we increasingly find in all European markets, Big Time Gaming’s licensed ‘Megaways’ mechanic games feature strongly, including Bonanza and Piggy Riches.

Operator site analysis – slots Q1 2020 vs Q1 2019

We also drilled down into the supplier mixes of some of the 10 sites in our analysis to see if there had been any signficant changes in the last 12 months.

- Unibet

There has been a reduction in NetEnt and a significant increase in Gamomat content on Unibet since last year. Gamomat has also gained a significant share on LeoVegas since launch as well as at Comeon and Betsson.Play’n Go and Pragmatic Play have again increased their respective content shares, a trend seen across several of the operator sites we analysed.

- Pokerstars

Notable changes at PokerStars include a substantial increase in share of Pragmatic Play and Play’n Go content since Q1 of last year, as well as a reduction of Red Tiger content.Core Gaming, owned by recently acquired Sky Betting and Gaming, also makes an appearance in 2020.

- Bwin

From Q1 2019 to Q1 2020 there has been an increase in the content share of its in-house Win Studios games development division.Again, we can see an increase in Pragmatic Play and a reduction in Red Tiger content.

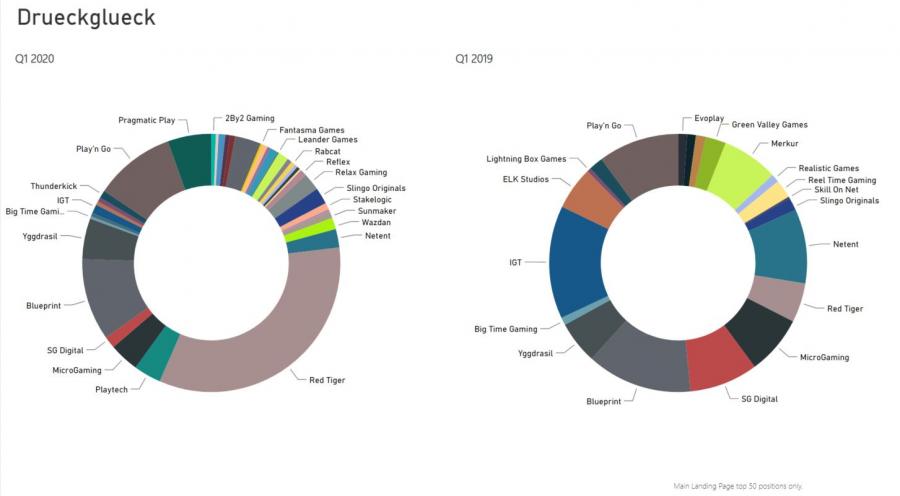

- Drueckglueck

The SkillOnNet powered and Schleswig-Holstein licensed site includes Blueprint content, making it unique amongst the other sites we analysed.While owner Gauselmann Group has taken a cautious approach to the country in recent years, in 2017 ordering German-facing casinos to stop offering slots produced by its Merkur subsidiary, the presence of Merkur/Blueprint content will no doubt rise after regulation.

Gauselmann also recently acquired platform provider Bede Gaming for €100m, which should help increase their digital capability worldwide.

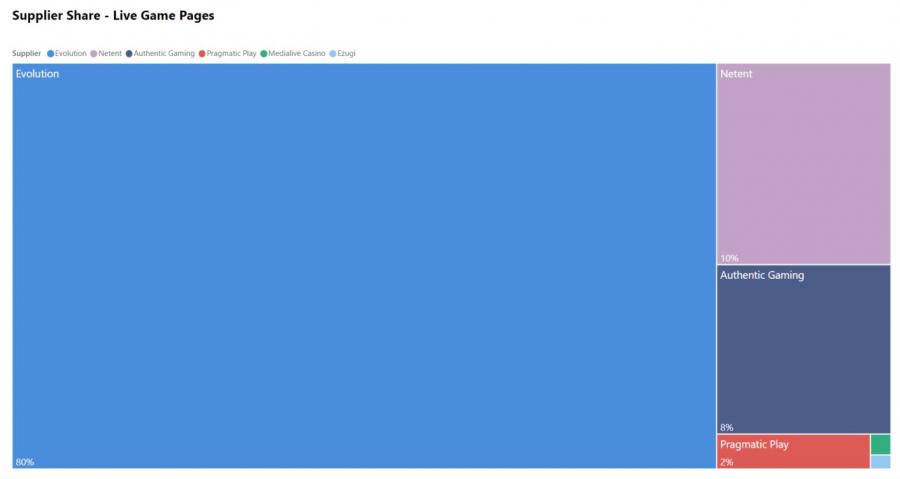

Live games

As mentioned in our introduction, the proposed German regulation clearly separates casino table games from slots.

Slots must be offered separately to other casino products, under a different licence, with German states given the option to extend their lotteries’ monopoly on draw-based games to products such as roulette and blackjack.

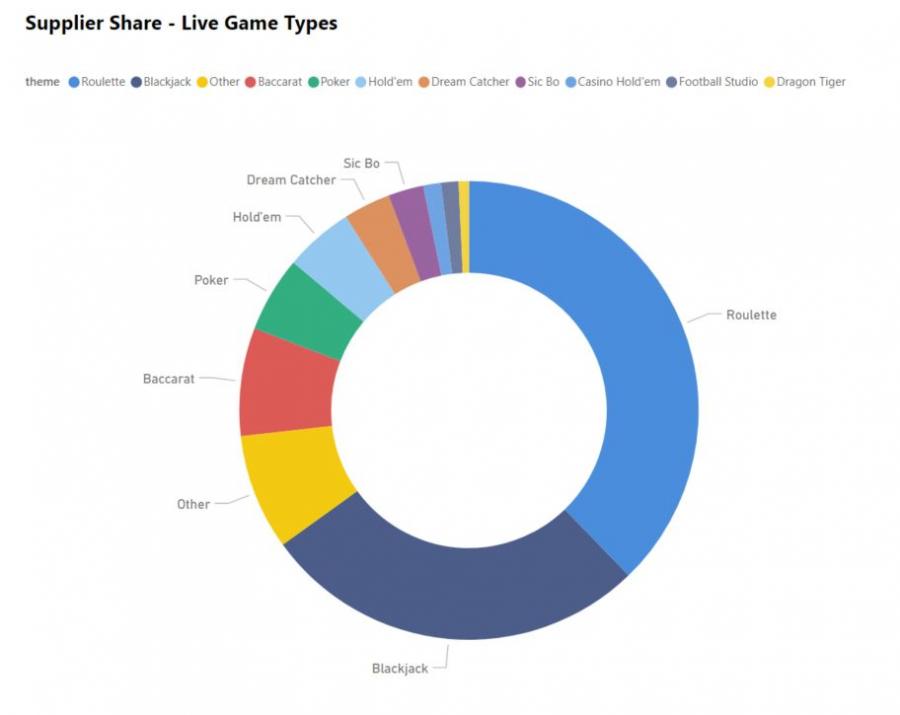

With this in mind, we looked at six popular live games pages in March 2020.

Typical to other markets the segment is dominated by Evolution Gaming, although NetEnt and Authentic Gaming are growing in market share with other suppliers such as Pragmatic Play and Ezugi also carving footholds.

While Playtech is not present in the sites we track in Germany for this specific part of the analysis, they are also a major player on sites including Bwin.

Challenges for regulation

There appears to be a signficant shift in supplier mix underway in Germany. Some of the trends are in line with those seen in other European markets, such as the growth in the share of Pragmatic Play content across operator sites.

Other trends seem to be more localised, for example the growth of Gamomat, a local studio which clearly understands the audience.

Jackpot games look like being unavailable in Germany under the new nationally regulated framework, which will change the slots mix available to operators and will hit some suppliers harder than others.

For example, Play’n Go and NetEnt’s content mainly consists of video slots, while other studios such as Red Tiger, now part of Netent, offer a more varied mix of games.

Most casino sites’ main lobbies currently have a mix of table games, live games, jackpot games and slots.

The mix may well have to change to the potential detriment of cross-sell, however most sites now have dedicated live game lobbies, where traffic will still be significant.

Sites used for analysis

For slots – Betsson, Bwin, ComeOn, Drueckglueck, Interwetten, LeoVegas, Mr Green, PokerStars Casino, Unibet, Wunderino

The analysis tracked main lobby pages. Content share in the analysis is calculated as the aggregated daily positions on the top 50 locations on the desktop ‘lobby’ in Q1 2020. All webpages were monitored in Germany using German language URLs.

For live games – Betsson, ComeOn, Interwetten, Leo Vegas, Mr Green, Unibet

The analysis tracked the main live game lobby pages. Content share in the analysis is calculated as the aggregated daily positions on the desktop ‘lobby’ in March 2020. All webpages were monitored in Germany using German language URLs.

All data from iGaming Tracker – how it works

iGaming Tracker tracks hundreds of casino sites worldwide every day. From this data it can ascertain which games are on which sites and where they are positioned on the pages. It can also measure the market share of casino games suppliers by percentage of “real estate” on casino sites at any given date.

For more information visit www.igamingtracker.com or email info@igamingtracker.com