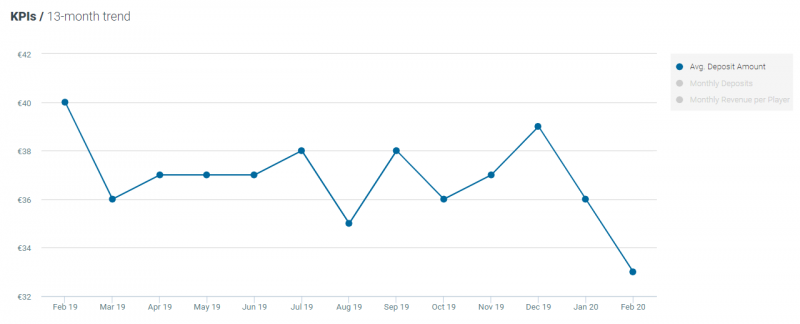

The month of February brought about a slowdown for sports betting providers, with a clear decrease in the average deposit amount.

The month of February brought about a slowdown for sports betting providers, with a clear decrease in the average deposit amount.

The online casino industry, on the other hand, had a better month, with gaming operators displaying a visible upward trend in both player retention rates and mobile bet rates.

Sport

The average single deposit amount was €33 in February, compared with €40 in February last year, representing an 18% decrease on a year-on-year (YoY) basis.

This was also a decrease of 8% compared with the previous month.

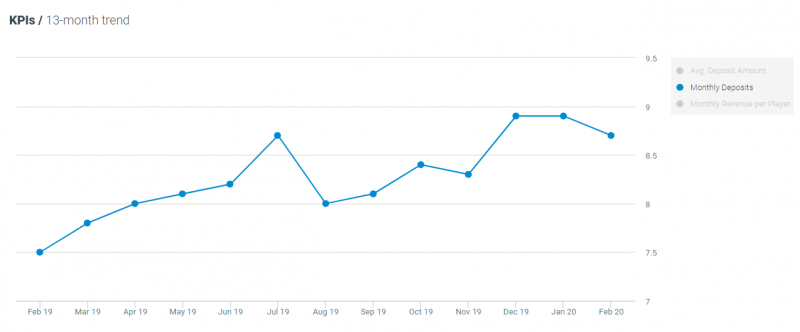

Although there was a fall in the average deposit amount, total monthly deposits increased by 16% on a YoY basis.

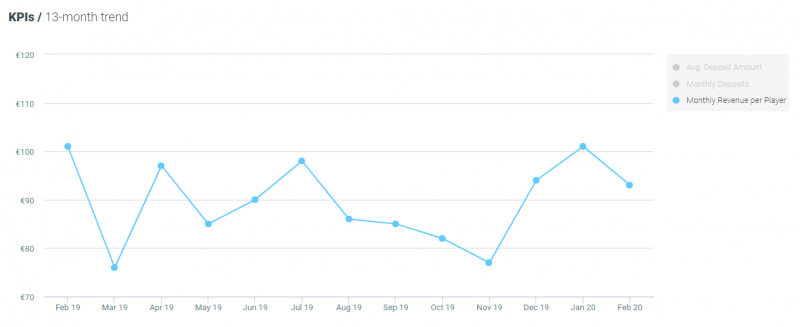

There was also a monthly decrease in revenue per player. More specifically, we saw a decrease of 8% on both a month-on-month (MoM) and YoY basis, with the figure falling to €93.

To counter this, marketers might want to consider encouraging higher deposit amounts in their campaigns, e.g., by offering incentives on pre-determined deposit amounts and aiming to increase average monthly deposits.

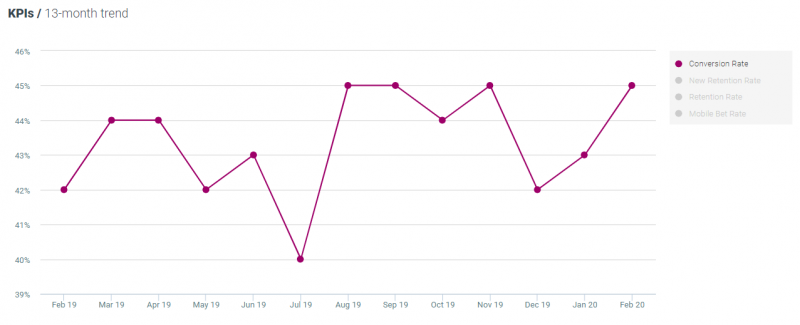

Optimove Pulse calculates the conversion rate as the number of first-time depositors divided by the number of players registered in a given time period.

In February, we saw an increase of 7% YoY and 5% MoM, with the rate standing at 45%.

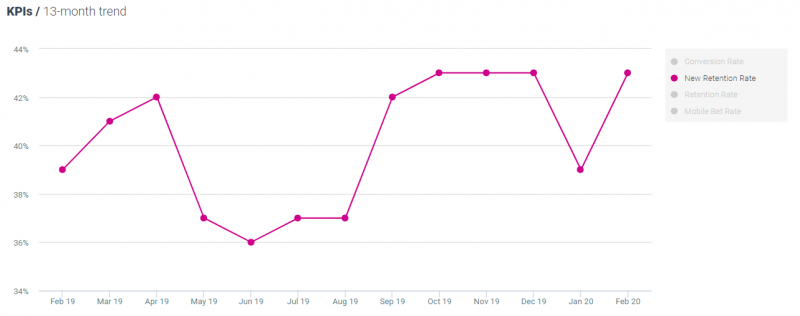

New retention is different from retention as it shows the number of players who made their first deposit in the previous period who remained active the next month. In February 2020, the new retention rate increased by 10% on both a MoM and YoY basis.

Casino

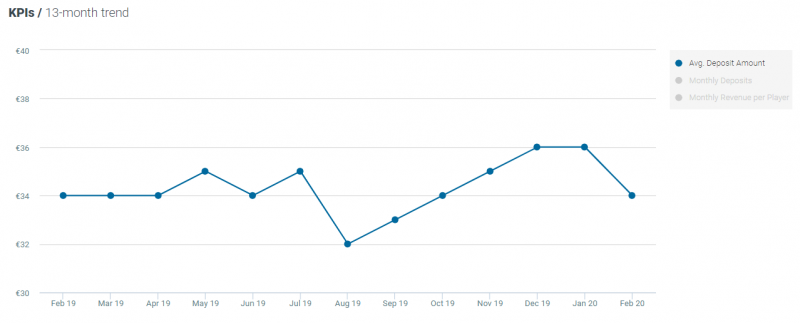

The average number of monthly deposits per player decreased by 6% MoM, while remaining the same YoY, at €34.

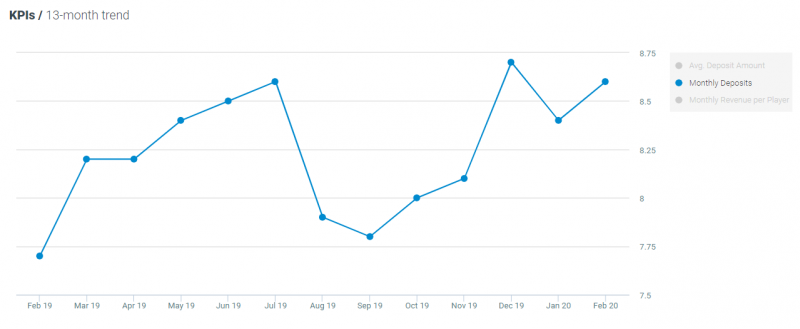

Monthly deposits increased by 12% YoY and 2% MoM, although the opposite trend was seen in monthly revenue per player, where we saw a decrease of 6%, both YoY and MoM.

Monthly deposits increased by 12% YoY and 2% MoM, although the opposite trend was seen in monthly revenue per player, where we saw a decrease of 6%, both YoY and MoM.

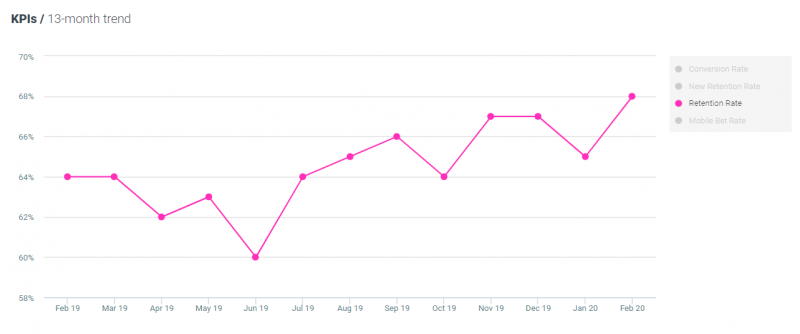

In terms of the retention rate, there was an increase of 6% YoY and 5% MoM.

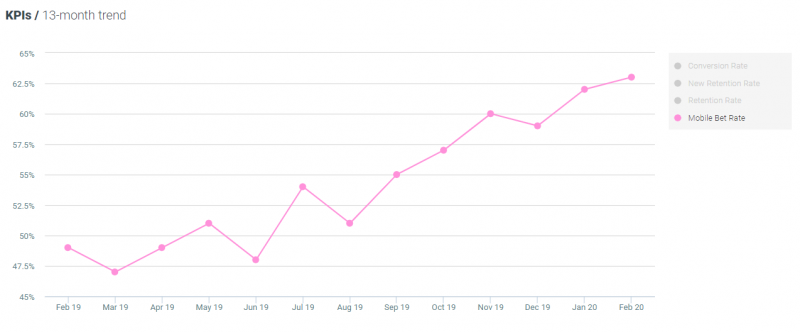

KPI in focus: mobile bet rate

The has been a rise in the percentage of igaming taking place via mobiles since last year. In February, 63% of casino bets were placed via mobile devices, compared with 49% last year, representing a 28% increase.

Migrating players to placing bets on mobile by encouraging them to download operators’ mobile app and play on the go has become more popular in the online casino space. The shift to mobile is increasing player engagement levels, allowing players to play wherever they are, whenever they want.

About iGaming Pulse:

iGaming Pulse is an industry benchmark tool for the gaming sector. iGaming Pulse enables gaming operators to accurately assess their overall performance against industry-wide key performance indicators.

Its figures are updated on a monthly basis. It enables gaming operators to gain a clearer understanding of how their KPIs compare against the rest of the industry, broken down by geography and game type. This type of data, which is made publicly available for the first time, provides operators with the ability to conduct comparative analysis and derive insight into how their performance compares with industry averages.

iGaming Pulse comprises of data collected from over 200 online casinos and sports betting companies, including industry giants and boutique operators, providing an accurate, statistically significant sample of the industry. Access to this information is vital for operators that are limited to only their own data. Optimove’s iGaming Pulse is now fully accessible, ensuring operators will have a clearer overview of how they compare to the industry.