Searches for unlicensed casino are already up in Sweden, and channelisation rates are falling. But should new restrictions for online casino be pushed through by the country’s government, the situation stands to significantly worsen, writes BonusFinder’s Fintan Costello.

At no point, in any industry, should the black market be given any further incentive to grow. Never has this become more apparent than during the ongoing global pandemic which has touched every corner of the globe and impacted every facet of every economy.

Online black-market sellers are thriving at this time of great uncertainty. From protective clothing and fake virus tests to peddling so-called cures on auction sites, you name it, they are flogging it to most vulnerable in society, and with no qualms.

Our industry is no different and it has taken reams of regulation and lobbying for them to gradually decline.

But not everywhere. Regrettably, in some less mature markets such as Sweden, these unlicensed brands are not only flourishing, but growing more powerful every day. This is not through their own efforts but inadvertently due to political inexperience in this area – arguably an issue every government has faced when opening a new gaming regime.

At the end of April, the Swedish government proposed to introduce mandatory limits on weekly gambling deposits, further restricting player bonus offers to SEK100 (just £8) and imposing compulsory time limits on casino games. All this in addition to some of Europe’s toughest casino regulations.

These are unprecedented times and the proposals have been put forward with the best intentions to protect players, but as we clearly stated in our response to the government’s consultation last week, we firmly believe this will further fuel the black market and drive more players – many of them vulnerable – away from legal brands to unlicensed sites.

On black market sites players do not have the same safeguards that are offered by Swedish licensees and run a greater risk of having their funds withheld or developing problem gambling behaviours. Equally, while the new restrictions would only be in place for six months, the consequences would also be felt for a longer period of time as players lost to the black market would not instantly, or very easily, return to regulated sites once measures are lifted.

Even the Swedish regulator agrees, stating in its response to the consultation that despite the proposals being in the “correct spirit” they should be weighed against the “potential negative effects on channelisation”. This is known to be as low as 70%, not the government’s previously stated 90%.

So, if it’s numbers they need to persuade them to rethink their strategy then I urge them to read on.

The evidence grows

In March this year BonusFinder.com research found that almost a third of Swedish online casino players are searching online for ‘unlicensed casinos’, with growing numbers turning to black-market brands due to the market’s restrictive gaming regulations, introduced in January 2019.

Just eight weeks on from our initial study, we have found this is rising at an alarming rate.

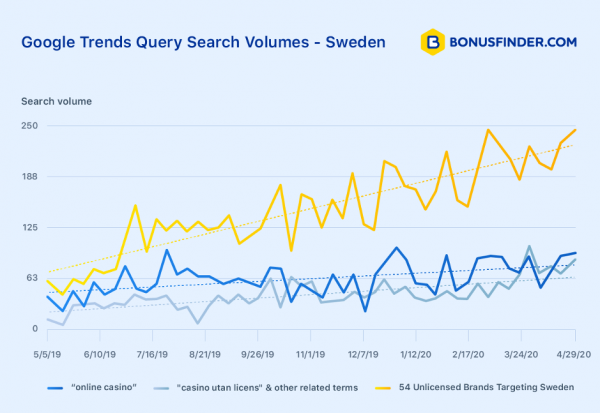

Using Google Trends, growth in searches for unlicensed casino brands targeting Sweden has risen by 305% in the last 12 months. We have identified more than 54 unlicensed sites targeting Sweden compared to 65 licensed operators with the majority offering online casino.

Over the course of the last year searches for “online casino” have grown by 173%, but this is nothing when compared to “casino utan licens”, unlicensed online casino (and other similar terms), which has seen a staggering 710% growth.

The Covid-19 pandemic has meant many are staying at home, and active casino players alongside revenues have broadly risen as a result, however I would be shocked if these numbers don’t make even the most obstinate of Ministers sweat with unease.

If lawmakers fail to absorb these statistics and do not alter the course of their approach to player protection, the influence of black-market brands will not only continue to increase but also rapidly overwhelm licensed, tax paying brands resulting in a sharply negative effect on the economy and the regulated industry.

Operators are already severely hamstrung by restrictive regulations and any further sanctions would instantly render the market uncompetitive in comparison to illegal operators, who can offer tempting bonuses and limit-free play.

Worst case scenario, this would give rise to an unworkable and unprofitable market, the speedy departure of already-suffering licensed brands, job losses and a significant loss of revenue for the Swedish treasury. And a time like this, that is far from unthinkable.

Fintan Costello is Managing Director of BonusFinder.com an Amsterdam-based start-up focused on helping people ‘Play With More’. Be it buying, selling, leading, consulting, building, speaking and writing, Fintan has covered almost everything in the industry in the last 12 years. He is now focused on searching the world for the best casino bonuses, running ultra-marathons and playing Mario Kart with his son.