bwin.party became the first igaming company to sign a sponsorship agreement with major US professional sports teams when it announced its sponsorships of basketball team the Philadelphia 76ers (known locally as the Sixers) and the New Jersey Devils of the National Hockey League in January. iGaming Business finance editor Melissa Blau spoke exclusively with all the parties involved in the partnership to learn more about the story behind this ground-breaking deal and what it means for the future of online gambling in the United States.

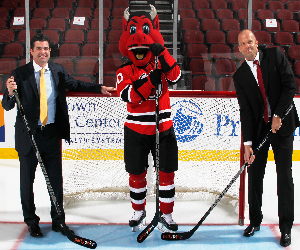

bwin.party became the first igaming company to sign a sponsorship agreement with major US professional sports teams when it announced its sponsorships of basketball team the Philadelphia 76ers (known locally as the Sixers) and the New Jersey Devils of the National Hockey League in January. iGaming Business finance editor Melissa Blau spoke exclusively with all the parties involved in the partnership to learn more about the story behind this ground-breaking deal and what it means for the future of online gambling in the United States.On January 9, 2014, news of the multi-year marketing partnership between online gambling giant bwin.party, which owns PartyPoker, and the two teams along with the Prudential Center, home of the New Jersey Devils, was leaked to the press on Bloomberg News. bwin.party chief executive Norbert Teufelberger and Scott O’Neil, chief executive of the Sixers and Devils, met on the ice at Prudential Center in Newark to formally announce the deal.

Celebrity endorsement for the partnership at the event demonstrated just how important this was for both sides. Both CEOs were joined by former Devils legends Ken Daneyko and Bruce Driver and by ex-76ers players Allen Iverson and Moses Malone. Even PartyPoker’s long time spokesperson Mike Sexton was there to partake in the return of the PartyPoker brand to the United States after a seven year hiatus.

In order to make a transaction of this nature successful, it requires the right mix of people to get things done. There is no doubt that there were roadblocks along the way, getting the green light from both the NBA and NHL requires understanding of how to manoeuvre through both organisations.

The affiliation of gambling and sports has always been a tenuous one. A transaction of this type also requires a critical level of experience from an online gambling operator who understands the sponsorship sub-sector, who has experienced both the upside as well as the many pitfalls. Without this mix of people, a transaction like this would be close to impossible to pull off.

It’s also true that not everyone sees the potential here. Some question if PartyPoker could have better used its marketing budget on direct marketing initiatives, pushing affiliate relationships and search engine marketing. Maybe they are right; at least for now while the player funnel in New Jersey remains dismal due to payment rejections of over 50%, while geolocation issues continue to hamper the player experience.

The monthly revenue figures the New Jersey Department of Gaming Enforcement (DGE) issued in January were less than stellar, garnering US$8.3m in revenue since the November 21 soft launch. In these early days, it has been a pretty painful experience for the casual player to make a deposit and play regularly. High credit card and ACH rejection rates, coupled with inconsistent geolocation messages, leads us to believe that the majority of people who are playing are the early adopters, the hardcore gamers and poker enthusiasts.

In these first few months, why would a New Jersey gaming operator heavily spend on brand advertising? Remember, launch was during the Christmas season when advertising rates are sky high. Why would an operator advertise heavily during a period in which it is not unexpected for a regulator to tweak policies to address unforeseen issues and ensure a safer environment and better player experience? Many of the operators chose to preserve their marketing spend for the first half of 2014, once the payments, geolocation and mobile issues work themselves out.

PartyPoker, with guidance from its parent company bwin.party, was not one of those companies. In true bwin fashion, it did not sit back and wait for the early market issues to sort themselves out. The company chose to aggressively grab market share. It chose a strategy that didn’t cater to hardcore gamers and poker professionals.

In 2006, prior to the merger with PartyPoker, bwin pursued a similar strategy of exclusively tying up sports teams and leagues with various types of sponsorship across Europe. It was a risky strategy for its time and many questioned if bwin would ever generate a profit. The partnership with the Devils and Sixers was true bwin-style: grab market share early, worry about profit later.

According to Adam Krejcik, analyst at Eilers Research, “bwin.party certainly has experience monetising sponsorship deals in Europe and still has decent brand equity in the US even though it has been out of the market for a number of years now. Another positive is that this form of advertising is clearly directed more towards mass market and so it should not just help PartyPoker, but increase overall awareness for iGaming in New Jersey. To me, this will be a key factor in terms of online revenue growth in New Jersey, the hardcore gamers and poker enthusiasts will undoubtedly be the early adopters, but reaching the mass market/casual gamer who maybe visits a land-based casino once a year or never is much more difficult, but critical in growing online revenues.”

For a sports team or an arena to align themselves with an online gambling operator could potentially alienate some customers or other stakeholders such as leagues or associations. Therefore, support for a transaction of this nature needed to be universal internally, along with well-executed public relations strategy. Both teams, now under the same ownership, have recently been purchased by an investor group led by two bright, young finance executives with close local roots to the teams.

“This is an amazing opportunity to partner with a brand that stands at the top of its industry. PartyPoker, through its parent bwin.party, has aligned itself with many of the biggest brands in sport across Europe. It’s no surprise they have taken an early lead as the number one spot in New Jersey for online gaming,” said Devils and 76ers co-owner David Blitzer. “Our organisations in New Jersey and Philadelphia are growing strategically yet quickly, and we strive to continue to innovate ways of doing business. This is the first of many collaborations that will define our success moving forward.”

The Devil is in the detail

The landmark partnership is estimated to be worth a minimum of US$10m over four years, according to sources with direct involvement in the deal. As part of the agreement, PartyPoker is the official online gaming partner to the Sixers, Devils and the Prudential Center. The PartyPoker brand will gain exposure to multiple media channels at the venues, online and through social media, as well as direct touch points to the consumer.

Included in the partnership is the integration of PartyPoker into the Devils and Sixers websites, mobile apps and social media channels as well as tickets and hospitality, in-arena signage (dashboards, on-ice and on-court) and rights to broadcast television and radio advertisements during Devils and Sixers games. In addition, booths will be set up at the venues to educate attendees on the steps necessary to open a PartyPoker account.

When asked about the appropriateness of such signage at events catering to the families and younger children that make up the sports following community, Scott O’Neil responded confidently: “I can say unequivocally that when Disney on Ice comes in, there won’t be PartyPoker signage. We have six years of experience working with land-based casinos and we are comfortable and confident that we can put and have put the right controls and targets in place to make sure that the promotions are seen by the right people.”

The most innovative component of the partnership was the creation of the Dream Seat Poker Tournament, where fans play for the chance to win regular, courtside and VIP box seats to every New Jersey Devils and Philadelphia 76ers home game as well as the ability to bring a friend on a road trip with the team.

The group also plans to tap into the current two million people who pass through the Prudential Center every year as well as compete for premium seats for concerts and other events at the Prudential Center, such as the Jay Z concert in January. According to Teufelberger, “this is truly ground-breaking. It’s the first time a poker network has created a dedicated series around sporting events.”

Both sides wasted little time after the announcement broke, the PartyPoker logo was already splattered all over the Sixers and Devils’ websites and was also ready for prime time television the very next day with simultaneous “arena takeovers” in both the Prudential Center, when the Devils hosted the Florida Panthers, and the Wells Fargo Center, where the Sixers played the New York Knicks.

Teufelberger was particularly excited about the inclusion of the Prudential Center venue as part of the overall sponsorship, anticipating it would deliver greater engagement with the fans and consumers. “In Europe, it’s more difficult to engage the consumer. We have a 90 minute window to reach the fans during the (football) match, and then they are gone. In the US, the fans are more engaged with the brand of the team, and this allows us more opportunities to engage with the consumer even after they leave the stadium.”

The celebrity participation is another aspect of the partnership that makes it truly unique. According to O’Neil, “We’re incorporating our legends, guys like Devils Legend Ken Daneyko. He won three Stanley Cups with the Devils and is a fixture in the community as well as a TV personality. Allen Iverson, I would say is the same on the Philadelphia side. He’s one of those guys that can light up a room. When you have such strong iconic legends in and around an agreement, I think it really helps the visual environment come to life.”

A new era for the Sixers, Devils and Prudential Center

Scott O’Neil stated at the press briefing that the two teams along with the Prudential Center strive to be the most partner-friendly company in the world. “This is our flag in the ground that we do things differently. We’re looking for groundbreaking opportunities with companies willing to take chances.”

O’Neil joined the group just six months prior and has vowed to shake things up. A long-time veteran of the NBA and Madison Square Garden, his involvement in the transaction was critical. According to sources close to the transaction, his ability to understand how to manoeuvre through the inner workings of the NBA was instrumental in getting the deal to close.

He understood the potential issues with regard to the rules and regulations, and he knew the people inside the organisation that were effective in getting things done. The Sixers, Devils along with the Prudential Center have recently been purchased by an investor group led by David Blitzer, a senior executive at Blackstone Group, and Joshua Harris from Apollo Global Management. Both owners are young and enthusiastic and have been known locally to inject an energy at the games interacting with the fans of the teams.

The group initially joined together in the summer of 2011 along with fellow Wharton School University of Pennsylvania graduates, finance executives and a small group of other investors to purchase the Sixers for US$280m from Comcast-Spectator. Two-years later, the group further expanded their investment with the purchase of the New Jersey Devils, New Jersey’s only official major sports team.

The purchase included rights to the Prudential Center and was estimated to be over US$320m. Since the purchase of the Devils, the investor group has been active, changing the management team with the hiring of Scott O’Neil as well as numerous other executives in the past six months. Today, Forbes estimates the value of the Sixers at US$428m, a big rise on the US$280m purchase price in 2011.

The right team meets the right time

The timing of the legalisation for online gaming in New Jersey could not have happened at a more ideal time for this new management team. Taking advantage of the upcoming launch of the New Jersey online gaming market, the senior management team met with several potential online gaming operators that were likely to enter the market. Caesars Interactive was rumoured to have been one of the companies, given that co-owner Joshua Harris, through his affiliation with Apollo Global Management, is an owner of Caesars Entertainment.

It is likely that Caesars passed on the transaction as it does not have much experience in the world of sports sponsorship and the management team, seasoned veterans of the online gaming industry and, ironically, a number former PartyPoker executives; has not pursued a strategy of early aggressive market share acquisition similar to that of bwin.party.

What makes PartyPoker the obvious partner is the company’s vast experience in sports sponsorship as well as a history of taking large risk, investing heavily in early stage markets. Starting in 2005, bwin (prior to the merger with PartyPoker) was the most aggressive operator, inking marketing partnerships across Europe in an effort to gain market share. In 2005 to 2007, bwin went on a risky spending spree tying up sponsorships with numerous leagues, teams, and venues in various countries across Europe.

The spending culminated in bwin’s famous shirt sponsorship of Real Madrid, a partnership worth well over US$60m over three years. Despite the risk, the investment did pay off. Not only did bwin turn a profit after it curtailed its marketing spend in 2009 to 2010, but it also gained more insight into sports sponsorships than any other gaming operator. Now, bwin.party is leveraging this experience in the US online gaming market.

Regulations

One of the big hurdles in completing this transaction was the regulator constraints that lie with the sports leagues. Sports leagues have been very cautious when it comes to affiliating themselves and their teams to the gambling sector. Currently, National Football League and Major League Soccer rules prohibit teams from accepting real money gaming sponsors. Major League Baseball spokesman Pat Courtney said it considers such deals on a case-by-case basis and when asked about the Sixers-Devils deal, he wasn’t aware of any existing agreement.

In order not to violate league rules and allow for the PartyPoker partnership, both the NBA and NHL had to change a few of their rules and regulations to allow for a sports-online gaming affiliation. According to O’Neil, “the NBA has been at the forefront relative to the other leagues with regard rules and regulations that enables the teams to actually get to market and drive revenue”. According to NBA executives, there are currently 28 teams that have casino sponsorships and 20 teams have deals with local lotteries.

The NBA changed its rules six years ago to allow its teams to affiliate themselves with land-based casinos in an effort to generate revenue through sponsorship and subsequent exposure for the team. Caesars Entertainment previously backed the New York Mets baseball team, while the Mohegan Sun casino backs the New York Yankees franchise.

However, prior to this agreement, the rules for the NBA and NHL only accounted for land-based casinos and specifically did not include online gambling affiliations. In order to get the PartyPoker sponsorship deal approved, the existing rules needed to be “tweaked to make it applicable for online gaming”. The education process included a deeper dive into the inherent differences between land-based and online customer engagement, including the addition of social media and digital activations as well as a core understanding of online gaming and sports team sponsorships.

Implications for the future of sports betting in New Jersey

Sports betting in the US is prohibited outside of Nevada and as part of the press coverage of the deal, the NBA sent a statement to the Associated Press clarifying its stance with regard to its rules and regulations. The statement was issued by NBA vice-president Mark Tatum: “As long as the gambling site doesn’t include sports gambling or sports betting, it’s now allowed within our rules.”

So what does this mean for the future of sports betting in New Jersey and does it affect the chances of New Jersey overturning the Professional and Amateur Sports betting Act (PASPA). The state has a lawsuit against the federal government currently working its way through the court system on its way to the US Supreme Court. Could this deal in any way hamper New Jersey’s efforts to overturn PASPA? Does the fact that a leading European sportsbook operating in New Jersey cut a deal with a sports team under the agreement that it will not offer sports betting on its website make a statement about the viability of sports betting in New Jersey in the near future?

According to Joe Brennan, a leading iGaming consultant in New Jersey, “the deal between a gaming company and an NBA or NHL team has no bearing on the viability of New Jersey’s legal challenge. While it demonstrates the degree to which the leagues will turn a blind eye to sports betting when it’s in their financial interest to do so (bwin.party operates one of the internet’s most heavily-trafficked sports betting sites, where punters can place daily bets on the 76ers and Devils, as well as the rest of the NBA and NHL teams) it says nothing that would affect whether the US Supreme Court will take on New Jersey’s appeal. Only the consideration of PASPA’s constitutionality matters.”

Measuring Success?

Was PartyPoker too quick to the draw by committing to a US$10m, four-year sponsorship deal that tied up two teams with fanatical fans and a venue that sees annual foot traffic of two million people? If bwin’s success in grabbing early market share in Europe is any indicator, then the answer is no.

If brand exposure and engagement is the end game, then this is a home run, or maybe in this case, a three point shot swish for PartyPoker. bwin.party has already announced to the investor market that it intends to invest US$5m-US$10m in ‘start-up costs’ in New Jersey.

According to Teufelberger, “it’s very hard to measure success for a specific sponsorship. A high profile sponsorship is great for brand awareness but it’s also about how well you engage the fans. This is the cornerstone of our strategy. In Europe, it seems everyone else tries to copy us. We are trying something new in the United States, and only time will tell if we are successful or not.”

Whether it is successful or not for PartyPoker, this is a huge success for the online gaming industry as well as the overall New Jersey online gaming market.

source : www.igamingbusiness.com